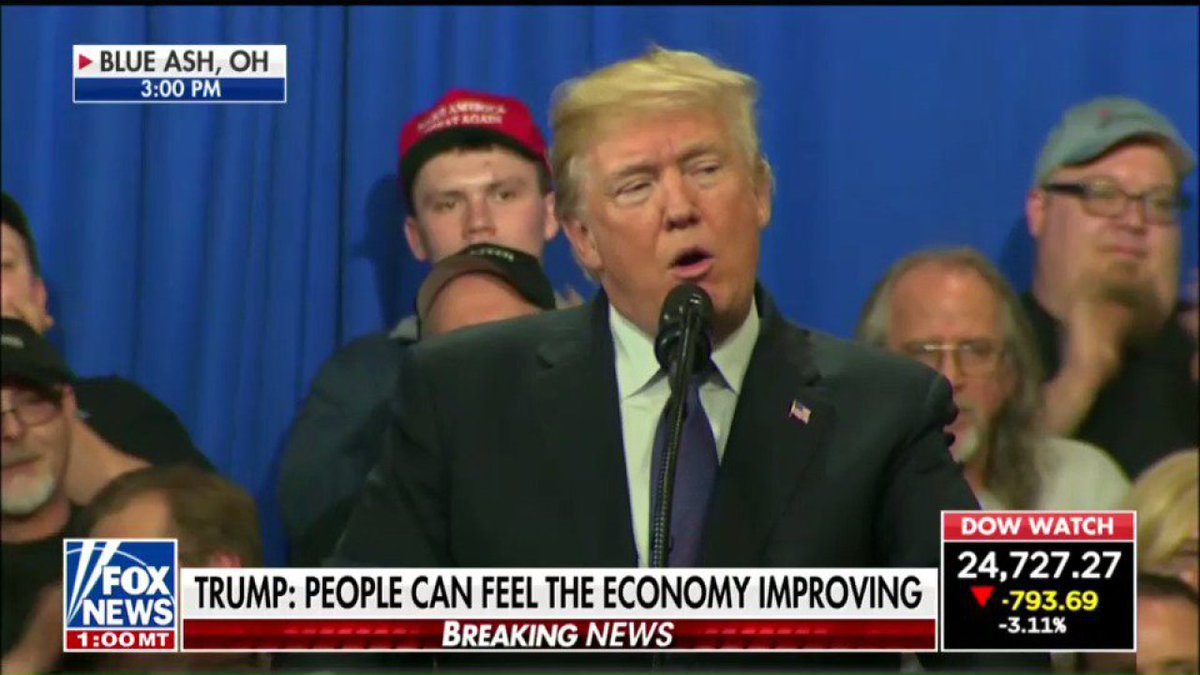

Should maybe think about selling...the Dow crashed today (largest one day points crash in history eclipsing the 2008 record crash by over 300 points).

Fox News had to interrupt Trump bragging about the economy in Ohio to cover the largest Dow drop in history.

You really wanna go there on this ricky bubba? Because you are going to run out of CNN and Huffington Post talking points that you copy and paste.

You think one day or one week defines a market?

You moron.

And now you wanna tout gross number and not %'s? Make up your mind. No President gets credit or fault for what a market does in a day or week. NOT. HOW. IT. WORKS. Presidents get credit and fault for policies and direction that do things over months and years.

See the bold....although I'm sure your liberal columnists and bloggers from Occupy know much more than real economists....

Stocks have lost steam with investors refocusing on the potential for faster inflation growth. Job gains in January fueled those concerns, turning a spotlight on the Federal Reserve and its timeline for interest rate hikes. A stronger-than-expected gain of 200,000 U.S. jobs was seen as raising the odds that the central bank will increase its benchmark rate in March. The report also offered more evidence that the U.S. economy is gaining strength with wages climbing at their strongest pace since 2009.

A period of higher interest rates and stronger inflation would create a stark contrast to recent years, when accommodative monetary policies—headlined by near-zero interest rates—helped support the U.S. economy and equities.

The business climate will remain a positive for the stock market even after Monday’s selloff, according to Bob Doll, chief equity strategist at Nuveen Asset Management.

“This is technical, not fundamental,†Doll told FOX Business’ Liz Claman on “Countdown to the Closing Bell.†“This economic cycle is far from over.â€

Jeff Carbone, managing partner for Cornerstone Wealth, said there was “no real impetuous†for Monday’s pullback

“The backdrop of the economy is strong corporate earnings, positive economic data and tax reform. The fundamentals have not changed,†Carbone said. “Investors have been looking for a catalyst to sell off, and rising interest rates [and] inflationary signs, along with concerns of the Washington memo, are in the spotlight.â€

TOP 12 One Day Drops - % of DJIA

----------------------------------------

1 1987-10-19 1,738.74 −508.00 −22.61

2 2008-10-15 8,577.91 −733.08 −7.87

3 2008-12-01 8,149.09 −679.95 −7.70

4 2008-10-09 8,579.19 −678.91 −7.33

5 1997-10-27 7,161.14 −554.26 −7.18

6 2001-09-17 8,920.70 −684.81 −7.13

7 2008-09-29 10,365.45 −777.68 −6.98

8 1998-08-31 7,539.06 −512.62 −6.37

9 2008-10-22 8,519.21 −514.45 −5.69

10 2000-04-14 10,305.78 −617.77 −5.66

11 2011-08-08 10,809.85 −634.76 −5.55

12 2008-10-07 9,447.11 −508.39 −5.11